'America's leading investors and developers understand the urgency of the moment'

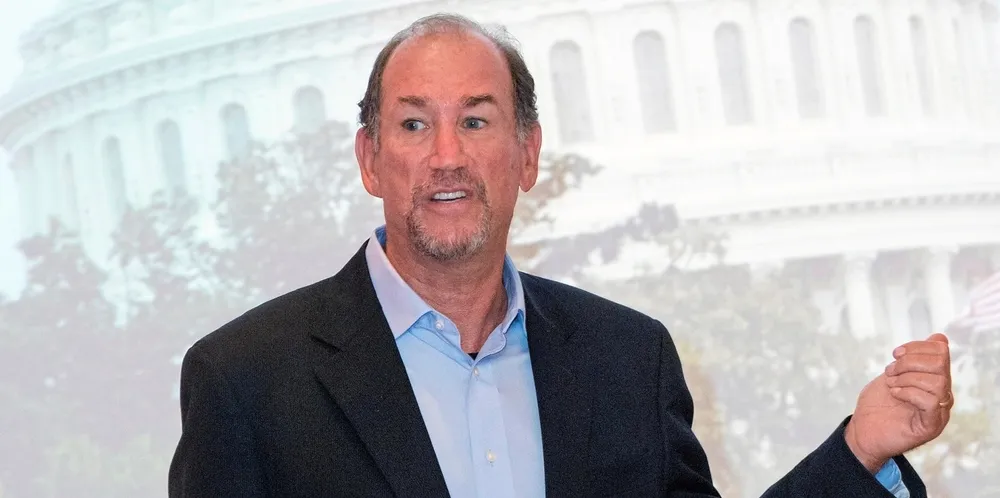

From bold climate plans coming out of the White House to increasingly ambitious clean energy targets from Fortune 500 companies, there is a fast-growing appetite for renewable power here in the US. Now we must capitalise on it, writes Gregory Wetstone

The momentum surrounding the renewable energy sector today is palpable. From bold climate plans coming out of the White House in rapid succession to increasingly ambitious clean energy targets from Fortune 500 companies, there is a healthy – and fast-growing – appetite for renewable power here in the US.

The results are exceptionally encouraging. Confidence among renewable energy investors and developers is at an all-time high. Nearly every company surveyed is planning to increase its investment or development activity over the next three years, with more than two-thirds of investors predicting increases of more than 10% this calendar year. As far as technologies go, energy storage and utility-scale solar now rank as the most popular investment preferences.

The findings suggest that 2021 will be a record-breaking year for the renewable energy and energy storage sectors. America’s leading investors and developers understand the urgency of the moment, recognising that now is the time to accelerate investments in renewable energy and grid-enabling technologies to avoid the worst impacts of climate change.

This is unquestionably an ambitious undertaking. But with the proper policies and market drivers in place, we can get there and put America on the path toward climate success.

To start, we need a federal tax policy that moves beyond the endless cycle of temporary stopgap measures and embraces a long-term, level playing field in support of carbon-free electricity generation. We also need to invest in upgrading and expanding our antiquated electric grid.

Unfortunately, one lingering effect from the Covid-19 pandemic is a constrained tax equity market that makes it harder for developers to use renewable energy tax credits. According to both investors and developers, difficulty securing tax equity financing remains a significant roadblock to accelerating the clean energy transition.

Congress can help maximise renewable energy deployment to meet our climate goals through enactment of a direct pay option that would allow developers the option of accessing financing directly as an alternative to traditional tax equity.

The critical next step is for Congress to translate these key elements into must-pass legislation this year. This is a once-in-a-lifetime opportunity to adopt smart policies that can boost our national economic recovery and help us secure the emissions reductions that scientists are calling for to avoid the worst impacts of climate change. Let’s not squander this precious chance to leave a better climate for our kids, and theirs.