'It's getting harder' | Pattern CEO on $10bn SunZia and America's grid problem

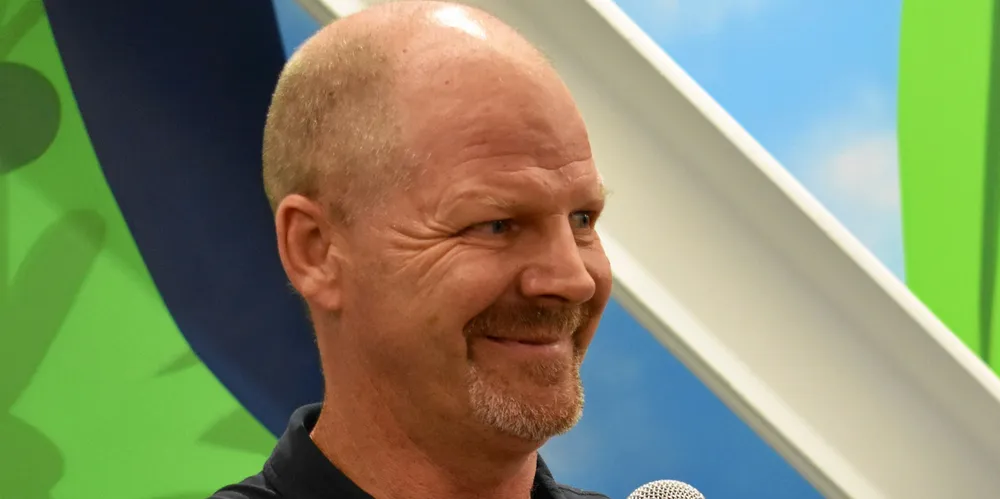

INTERVIEW | Hunter Armistead takes aim at challenges facing the US green power sector, with transmission high on the list

Independent power producer Pattern Energy is taking direct aim at two major hurdles the US will need to overcome to have any chance of achieving President Joe Biden’s ambitious 2035 national goal of carbon-free electricity: scale and delivery.

At present, the US is not adding renewable energy generation capacity fast enough to replace both fossil and nuclear plants scheduled for retirement through the mid-2030s and meet surging national demand turbocharged by long-term federal tax credits.

Against that backdrop, onshore wind, the country’s leading clean energy technology today, offers a large opportunity to help boost supply. But private consultancies believe the sector will expand far below its potential in the foreseeable future. Installations totaled 144.1GW on 1 January.

Pattern acquired the project a year ago which had been in development for more than 13 years. SunZia is in the same three New Mexico counties as Western Spirit and will have more than 3.5GW nameplate capacity. A 3GW, 550-mile, 525kV high-voltage direct current (HVDC) interstate transmission line will carry most of the power to western markets hungry for it.

“I think the challenge of developing onshore wind is in some ways limited by the upgrades to the grid to get generation from where the resource is to where the load is. Which is why projects like SunZia are so critical to creating more wind opportunities,” said Armistead.

Not short on ambition, Pattern intends to build the wind complex in a single stage and complete the entire project by early 2026.

SunZia will raise the bar for the US renewables industry. By comparison, the 1.55GW Alta Wind Energy Center in California, the nation’s largest wind farm, required most of last decade and 13 stages to construct.

Excluding legacy hydro, Alta Wind and Western Spirit are the only 1GW or larger operational renewable plants in the US.

It’s not only SunZia’s scale and scope that has Armistead enthused.

'Explosive growth opportunity'

“That is an incredibly explosive growth opportunity for the company,” he said, noting SunZia is similarly sized to the rest of the San Francisco-based firm. In March 2020, Canada Pension Plan Investment Board acquired Pattern in a deal valued at $2.63bn and then took it private.

Armistead said the project will elevate Pattern’s expertise around effectively managing a “well-shaped” product created in New Mexico and delivering it to distant customers.

That product derives from the uniqueness of New Mexico’s wind profile which complements solar out west, especially in California, the number two state power market after Texas.

The wind tends to ramp in the later afternoon hours through the early evening. In California, this is a period of high demand as millions of residents return home from work and when availability of solar diminishes and stored energy in batteries is released.

“We just need more of it. The product is really the shape. Opposed to delivering our product at the meter, we’re arranging firm transmission to take and ship it to the market,” he said. “Also, opposed to asking the market to come and get it, which is a little more the historical way that renewable projects have been done.”

Pattern has customers lined up for SunZia and is in the process of finalising the number.

“[With] all the challenges around supply chain and cost, we didn’t want to fully lock down pricing for what we’re willing to sell until we had a pretty good outline of what it was going to cost us to build it,” said Armistead.

As the market value of SunZia’s wind energy has dramatically increased with western states pursuing clean energy goals, Pattern will not sell all the capacity now.

“We see the value of this product getting even higher. We will end up holding some of it back. While we’re under construction and probably when we’re in operation,” said Armistead, noting Western Spirit has about a third of its output still merchant.

Texas power exports

Pattern is also advancing Southern Spirit, a 3GW, 320 mile, 525kV HVDC transmission project that would be the first merchant line to export clean electrons from wind- and solar-rich Texas, in this case, east to Louisiana and Mississippi when there is surplus supply in the Lone Star state.

Equally important, it could import them from the neighbouring regional grid whose operator is Miso that includes those two states when the main Texas electrical system, called Ercot, experiences supply shortages and resulting in extreme high prices.

This occurred in 2021 during Winter Storm Uri that killed at least 210 people in Texas and left millions without electricity for days in freezing temperatures.

Ercot, which serves 90% of Texas’ electrical load, is almost totally geographically isolated from the two main US interconnections. It also is largely independent from federal regulatory oversight as it does not cross state lines. Retaining that autonomy is politically sacrosanct in Texas.

“I think Southern Spirit was structured with respect and awareness of Ercot retaining its independence from the Federal Energy Regulatory commission,” said Armistead, adding there has been awareness within the Texas Public Utility Commission of the project’s importance for how helpful it could be during disruption.

“Being able to bring in that generation when Texas needs it is really great for the reliability of the grid,” he said. Likewise, “As opposed to delivering clean power in Texas, we’ll be delivering it in the southeast, which is quite interesting.”

Texas including Ercot and other balancing authorities on 31 March had 40.4GW of operating onshore wind capacity, more than triple number two Iowa, and 12.6GW of utility solar, second behind California.

Armistead said Pattern always had the view that Ercot was going to be very long on supply with a deep pool of renewables, but it might be capacity short. Texas has one of the fastest growing state economies and populations. It also saw the Southeast as capacity long but renewables short.

“When you have the short and long in the right place, you are going to get to the right place,” he said. “It’s taken commitment to see some of the challenges over the last 12 years we’ve been developing this project.”

Among the challenges has been working with regulators in southeastern states and Texas to implement the major rules to integrate Ercot and Miso as each now has its own to schedule generation.

Pattern expects to probably start construction of the line towards late 2026 for in service in 2029. If Southern Spirit is successful, this could open the way for other inter-regional merchant transmission lines involving Ercot.

Armistead notes that Pattern is an organisation that learns by experience and applies it to tackle problems such as transmission, each of them more complex as occurred with Western Spirit, SunZia, and now Southern Spirit.

“We see a lot of the work we do is building on itself,” he said.

(Copyright)