Meyer Burger halts plan for 'not financially viable' Colorado solar cell plant

Swiss company instead to continue sourcing cells from German site while also drawing up restructuring and cost-cutting programme

Meyer Burger in a reversal of its expansion plans has halted the construction of a solar cell factory in the US state of Colorado, which the Swiss solar cell and module manufacturer said is no longer financially viable.

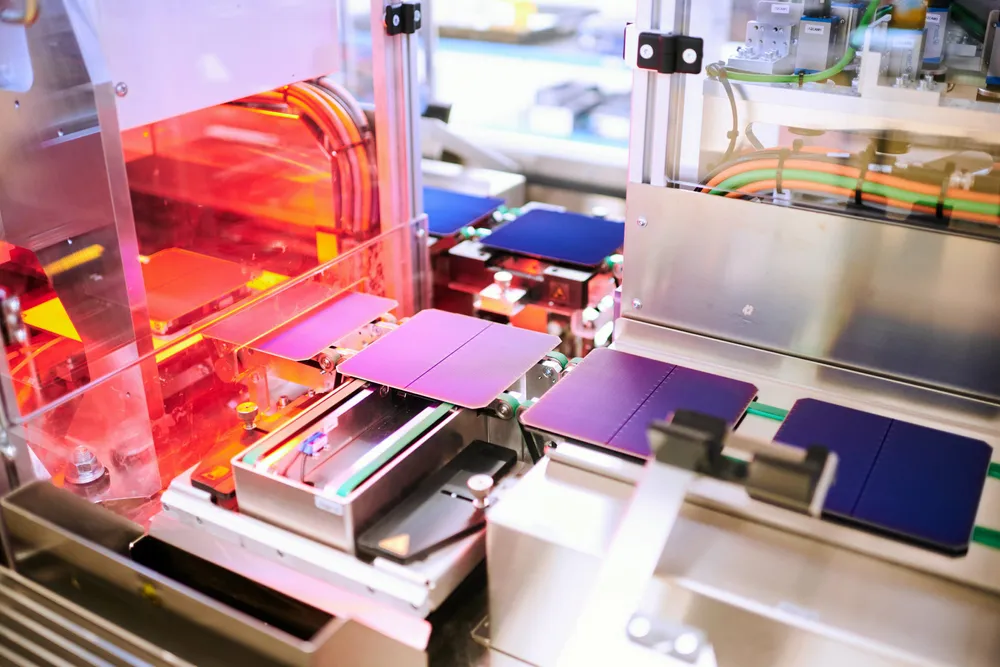

The company instead will focus on the operation of its 1.4GW module production in Goodyear, Arizona, which is currently being ramped up, and contrary to previous plans continue to use its cell production site in Thalheim, Germany, as the backbone of its solar cell supply.

“Under the current market conditions, these solar cells are the most economical option for supplying the module production in Goodyear,” Meyer Burger said in a statement.

The solar company earlier this year had said it would close Europe’s largest solar module factory in Freiberg, Germany, and concentrate on US manufacturing as Europe wouldn’t provide sufficiently competitive market conditions - while the government of US President Joe Biden with the Inflation Reduction Act was more helpful.

“In the USA – due to the industrial policy there – we can fully exploit our leading technology position, which leads to considerable interest from potential partners,” Meyer Burger CEO Gunter Erfurt had still declared earlier this year.

The tax advantages under the IRA now don’t seem to be sufficient anymore either, at least not for a shift of the company’s cell production to the US. Meyer Burger is also shelving a plan to increase its output capacity at Goodyear by an additional 0.7GW.

The company also is postponing the publication of the half-year results previously announced for September 16, 2024, to September 30, 2024, or, with the approval of Swiss stock exchange (SIX) regulation, to a later date.

“In connection with the strategic changes, the Board of Directors has instructed the Management to draw up a comprehensive restructuring and cost-cutting program. This should take account of the realignment and thus lead to sustainable profitability,” the statement said, as earnings before interest, taxes, depreciation and amortisation (Ebitda) are expected to be lower in the medium term after giving up the US cell plant plans.

(Copyright)