Penison funds swoop for stake in US renewables giant Pattern Energy

Dutch-Australian consortium to buy share held by Riverstone

A Dutch-Australian consortium has snapped up US private equity firm Riverstone Holdings' stake in renewables giant Pattern Energy, the companies announced Monday.

Pattern has some 10GW of solar, wind, and grid capacity in operation or under construction, including the 885-km SunZia transmission line linking a 3.5GW wind farm in New Mexico to demand centres in the US southwest and California, considered the largest clean energy development in US history.

Dutch pension fund manager APG Asset Management and Australian Retirement Trust (ART) fund teamed up on the deal, with financial terms and stake amount undisclosed.

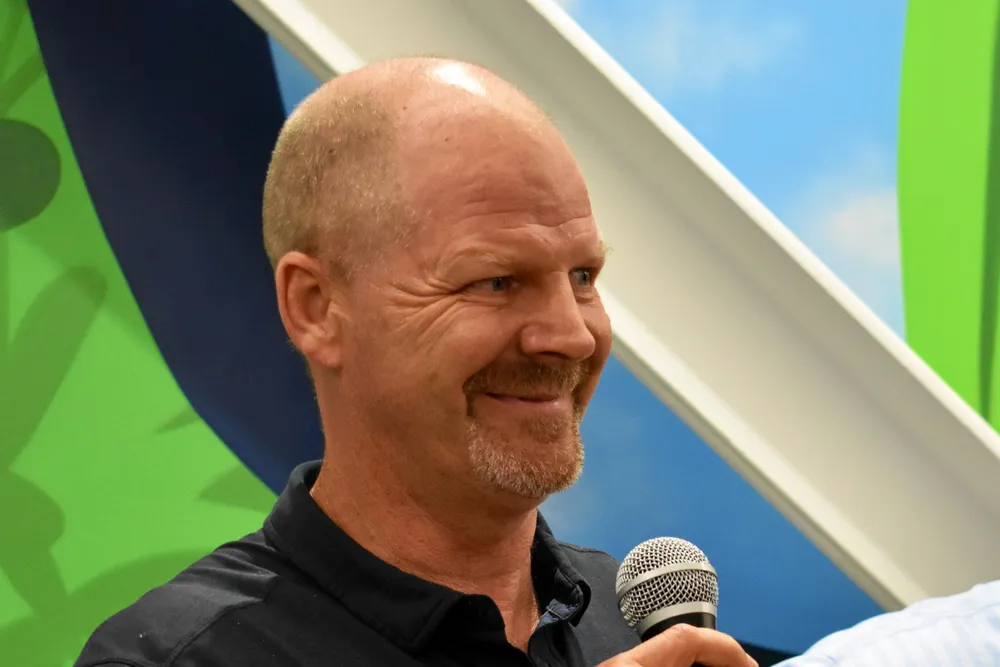

“APG’s and ART’s financial strength and commitment to the business will strengthen Pattern’s position as we rise to the challenge of meeting North America’s rapidly growing energy needs,” said Hunter Armistead, Pattern CEO.

Riverstone along with the Canada Pension Plan (CPP) Investment Board jointly acquired 35% of Pattern in 2019 for $6.1bn in a deal to take the company private.

The exit of Riverstone leaves ownership of the San Francisco-based firm in the hands of the new stakeholders as well as CPP Investments and Pattern management. The acquisition is expected to close in the first half of next year.

“The investment in Pattern Energy alongside our new partners is designed to generate sustainable, long-term returns, while also delivering tangible climate solutions and societal benefits,” said Steven Hason, head of Americas real assets at APG Asset Management US.

“The acquisition of Pattern Energy adds to Australian Retirement Trust’s growing investments in renewables.

ART Head of Global Real Assets, Michael Weaver, said: “We take our responsibility as a leading global investor seriously and we are confident this acquisition will provide strong returns for our members, while supporting our Net Zero 2050 Roadmap.”

Pattern said it “will leverage this new investment to advance its market-leading development pipeline of over 25GW of renewable energy and transmission projects.”

Renewables face an uncertain future in the US with the election of fossil fuel-supporter Donald Trump and Republican control of Congress.

Trump has put President Joe Biden's landmark Inflation Reduction Act (IRA) in his crosshairs for its generous tax credits aimed at spurring investment in clean energy manufacturing and deployment.

Congressional support for the IRA remains strong, however, even among Republicans, with “shovels in the ground” and new factories in their districts that depend on IRA tax credits, said Mike Catanzaro, CEO of Republican lobbying firm CGCN Group.

He was also special assistant for domestic energy and environmental policy to Trump in his first term.

Catanzaro told a recent webinar held by law firm Norton Rose Fulbright that he expects Republicans will take a “scalpel, not a sledgehammer” to the IRA.

(Copyright)