US clean energy to double market share on $500bn investment binge: ACP

Industry body says announced investments in wind, solar and storage can turbocharge contribution to energy system

The US clean energy industry has announced $500bn investment in the past two years which, if carried through, would enable doubling its present 15% share of the country’s electricity mix, according to a new American Clean Power Association (ACP) report.

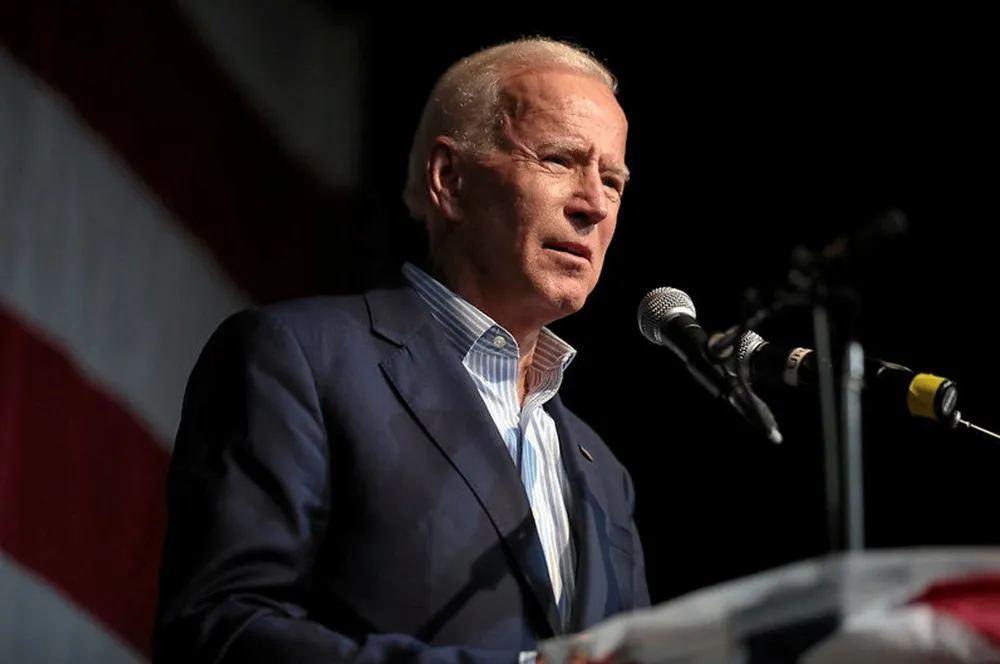

This amount is in addition to $75bn invested in clean power since President Joe Biden in August 2022 signed into law the Inflation Reduction Act (IRA), landmark legislation passed by Democrats in Congress on a party line vote.

There are more than 300GW of new clean power projects “currently in the works and looking to come online in the next couple of years,” John Hensley, vice president of markets and policy analysis at the national trade group, said on a media call. “This is more than double the 270GW of power we currently have in the system.”

“It’s important to realise these aren’t just promises. Investments are actually taking place and shaping the energy landscape across the country already,” said Hensley.

The remaining $136bn-plus in announced investment tabulated by ACP includes $61bn for manufacturing, $47bn in supply agreements, and $28bn in other areas such as port infrastructure and offshore wind turbine installation and support vessels.

Investors have announced 161 new or expanded manufacturing facilities spread across 38 of 50 US states, most of them battery storage and solar. Thirteen are onshore wind, 11 offshore wind, and 10 electric grid transmission. At least 42 of those plants are online and operating and 119 others are in development.

ACP is tracking projects that have secured financial close, signed a PPA, or met some other milestones, meaning they have progressed in their development cycles by the time they do get announced, according to Hensley.

The assumption is that most announced investment activity will conclude within five years although a “fair amount” of this will occur by 2027, he said, based on expansion levels seen since IRA took effect.

'IRA helping'

Hensley said lucrative federal tax credits made available through IRA are “helping to promote that investment and manufacturing renaissance we are seeing.”

In March, the Department of Treasury’s Office of Tax Analysis estimated solar and wind asset and supply chain facility owners will benefit from $276.6bn in production tax credits and $148bn from investment tax credits (ITCs) over the next decade, an unprecedented amount of taxpayer subsidy support for any energy technology.

OTA’s $424.6bn forecast is higher than the Biden administration’s initial $369bn estimate for all IRA climate-related spending and tax credits. As use of credits is uncapped, they ultimately could add $1-2trn to federal deficits through 2033, according to money centre banks and private consultancies.

Former president Donald Trump, a Republican, who is running for a second term, wants to eliminate most IRA tax credits if the party regains control of Congress. Even if it does, how many Republicans in the House of Representatives and Senate would support such a move is unclear.

Hensley conceded some new facilities or expansions announced may not cross the finish line despite federal subsidy support. There will be attrition, as “not everybody has the right business model or approach to doing this,” he said.

“Let’s be clear, especially in the solar and storage space, these are relatively new activities the US is engaging in,” he added. “There is always going to be risk and uncertainty to deal with, a lot of challenges to work through to really establish that manufacturing base and build that robust and enduring supply chain in the country.”

Hensley foresees a healthy level of competition among survivors making sure plants are on the right pathway to providing quality products to the market.

Companies that have scrapped proposed US plant investments cited profitability concerns with China flooding the global market with below- or low-cost components and products, and macroeconomic uncertainties.

For now, ACP anticipates the potential manufacturing investment will create at least 100,000 jobs – 20,000 generated by operational facilities and 80,000 from those in development.

(Copyright)