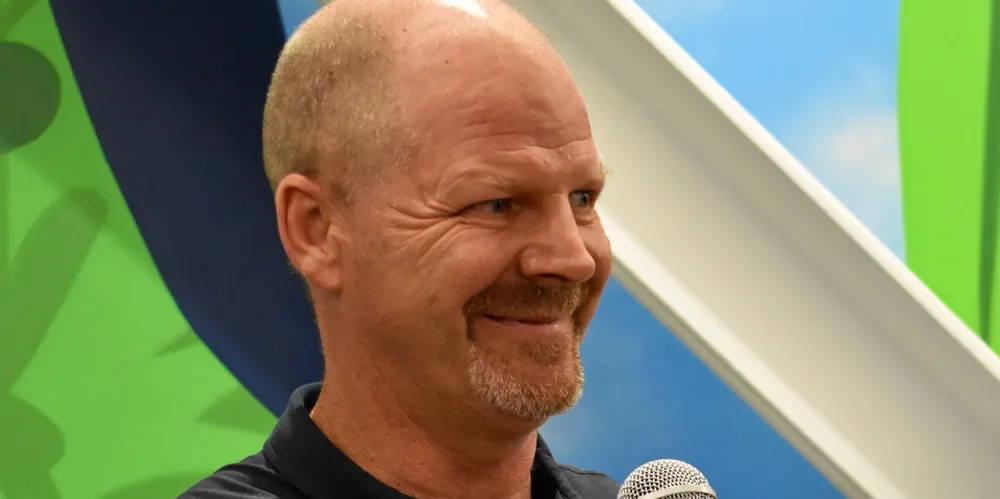

America's largest ever wind farm 3.5GW SunZia lines up two turbine makers: Pattern CEO

EXCLUSIVE | Developer closing in on deals for onshore mega-project in New Mexico, says Hunter Armistead

“Stay tuned,” he said. “We have arrangements with two turbine suppliers. We haven’t closed them but have them secured right now including the model numbers, pricing, and everything else.”

The turbines will have nameplate capacity in a range of 3.5MW to 5MW, reflecting the broader US industry trend toward higher power ratings onshore but well short of 6MW that several projects have ordered.

The entire wind and transmission project will cost $10bn, he added.

Armistead said Pattern discussed turbine supply with vendors that have nacelle and blade factories in the US. That limited the field to GE Renewable Energy, Siemens Gamesa and Vestas. Nordex, third in onshore turbine sales here behind GE and Vestas, imports from Europe.

GE has a nacelle plant in Florida and its LM Wind Power subsidiary fabricates blades in North Dakota. Siemens Gamesa builds nacelles in Kansas and blades in Iowa, while Vestas manufactures both in Colorado.

Pattern has bought turbines from all three OEMs for projects in the US and neighbouring Canada with the following nameplate rating ranges: GE, 1.5MW to 3.2MW, Siemens Gamesa, 2.3MW to 2.63MW, and Vestas, 3.45MW to 4.3MW.

The developer has been a major US customer for Siemens Gamesa along with MidAmerican Energy, the Iowa-based utility that is part of billionaire Warren Buffett's Berkshire Hathaway conglomerate. Both have favoured Vestas and/or GE for more recent projects.

“This is a very large order we are placing where OEMs will be utilising their existing footprints in the US for some components," said Armistead. He noted since President Joe Biden signed a landmark federal climate law last August, the OEMs have made commitments for new investment in component manufacturing and capacity expansion.

"This will lead to a project US-sourced production supply chain for SunZia and we certainly expect that to be the case in the future as well," he said, noting Pattern has a "deep pipeline of wind development to deliver on over the next number of years."

The Inflation Reduction Act (IRA) provides generous tax credits to build and expand turbine production lines, and also for assembly/fabrication of individual blades, nacelles, and towers.

All three OEMs are reliant on foreign sources for certain items. Gearboxes, for example, have 10% or less US content by value. Canada, Denmark, India, Mexico, and Spain supply about 80% of US imported turbine components by value.

Despite public perception in the US, China is a minor supply source consisting mainly of cast iron turbine hubs.

All three OEMs could source a 5MW nameplate capacity turbine from the US with the tax credits helping level the playing field with lower-cost imports.

Before IRA took effect last August, Vestas, for example, was not manufacturing its larger, newer turbines in the US because of the cost differential.

Armistead acknowledges the SunZia order will provide a shot in the arm for both the local supply chain and turbine vendors that Pattern selects. GE, Siemens Gamesa, and Vestas have posted billions of dollars in cumulative financial losses this decade.

The flood of red ink was due to multiple factors such as cut-throat pricing, global inflation, quality control problems, sloppy contract due diligence, spiking shipping costs, and taking on excessive commodity risk.

The OEMs also hurt themselves in a race to the bottom by delivering larger and larger turbines at lower prices. This was not sustainable for them, their supply chains, or the broader industry here that has seen the number of turbine suppliers shrink from 10 to four in the last 12 years.

"The turbine vendors are all realising that everyone has to make money through the whole system, which is exactly right," said Armistead, adding, "We've been having a consistent message with our vendors that they need to be healthy too."

(Copyright)