Canada ramps offshore wind with five areas while Trump drives US sector clampdown

Nation has excellent resources including strong steady winds and shallow seas but offtake will be a challenge

Canada, with its “stable regulatory environment, and decades of experience in offshore energy development, is well-positioned to enter the $1-trillion global offshore wind market,” the Nova Scotia Department of Energy said in a release.

Canadian ports are already active in the US sector due to maritime law that forbids foreign-flagged vessels from calling in at consecutive American ports or points on the outer continental shelf, including a wind turbine foundation.

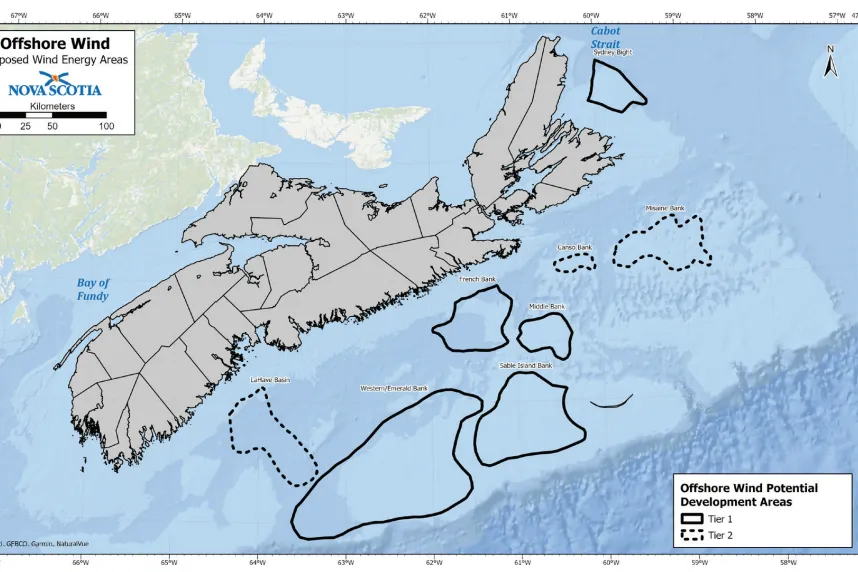

The five areas sprawl across 19,500 sq km, and could hold more than 6.5GW, based on US government standards, more than sufficient to meet the provincial goal of contracting 5GW by 2030.

“Our initial view is that these five areas will be of interest to industry and present opportunities for both fixed and floating offshore wind development,” said Elisa Obermann, executive director of Marine Renewables Canada, a trade group advocating for at-sea renewables.

“But more clarity is needed on the offtake opportunities,” Obermann added.

“What we can actually generate on the East Coast is spectacular, but we have nowhere to put the power,” said Dawn MacDonald, global offshore wind market sector leader for Texas-based infrastructure consultancy Aecom.

The two Atlantic provinces spotlighted for offshore development – Nova Scotia and Newfoundland & Labrador – combined have only around 1.5 million residents and low power demand. Nova Scotia's 5GW target would generate nearly twice its average annual power demand 11,000GWh, assuming 50% capacity factors.

Production of green hydrogen has been proposed as a possible market, and Canada has signed supply agreements with Germany. Offshore wind’s high costs make it less competitive than the province's also-abundant onshore renewables, though.

New England states and New York had planned on offshore wind to drive their clean energy and climate ambitions, but development has flagged under President Donald Trump’s efforts to derail the sector along with stubbornly high costs.

With development timeframes of at least a decade, “that will be a project that goes beyond this current US administration,” Obermann said.

Nova Scotia has opened public comment on the areas that closes 14 April, with sources optimistic of seabed leasing as early as this year.