Equinor and Orsted sign on dotted line with New York – again – for giant offshore wind arrays

Finalisation of offtake contracts with Nyserda brings longstanding drama to close as Empire and Sunrise projects target 2026 commissioning

New York State and offshore wind developers Equinor and Orsted finalised purchase and sales agreements (PSA) for the 810MW Empire Wind 1 and 924MW Sunrise Wind arrays, closing a tumultuous year for the sector that saw both projects falter amid surging inflation, only to be re-awarded at much higher offtake prices.

The PSAs were signed between the New York State Research and Development Authority (Nyserda), which is managing the state’s energy transition, and the developers and confirms the capacity towards the 9GW by 2035 mandate.

When completed, the projects can power over one million homes and deliver more than $6bn in economic benefits statewide over the 25-year life of the projects.

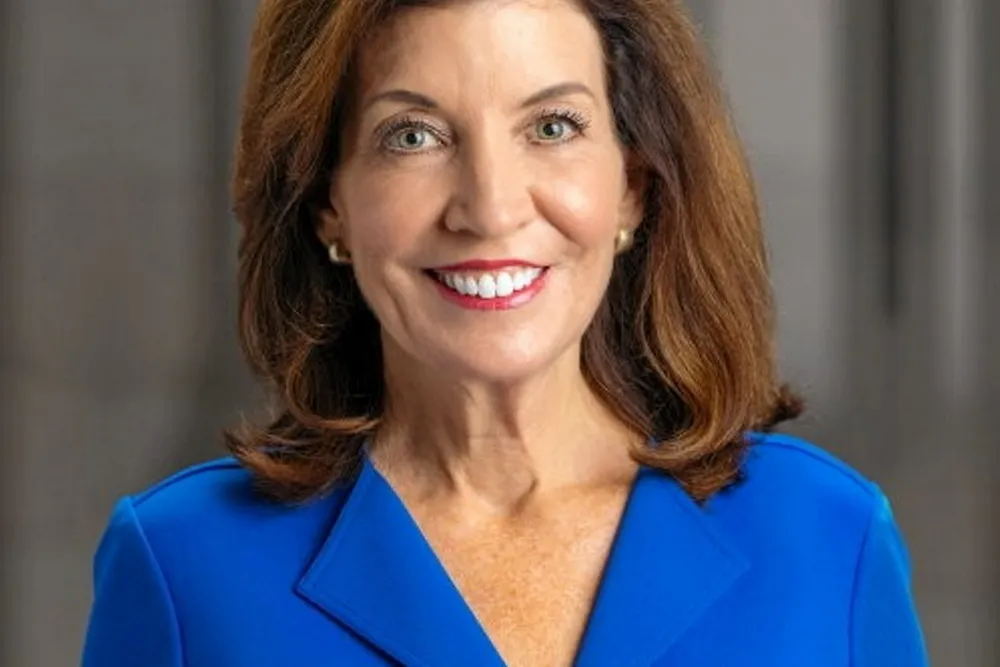

“Offshore wind is a critical piece of our clean energy blueprint to address the climate crisis, and our investments are building a healthy, sustainable New York so that future generations can thrive,” said governor Kathy Hochul.

Hochul’s administration has committed some $500m to infrastructure development for the industry that has been roiled by surging costs and supply chain disputes.

In less than a year, the state has had some 8.5GW of capacity under contract, only to see most of it cancelled, with these two projects and Orsted’s already operational 132MW South Fork remaining for a total of 1.86GW.

Round 4 resurrection

Equinor-BP had sought a 54% increase on average across its portfolio, which also included the 1.3GW Empire Wind 2 and 1.2GW Beacon Wind arrays.

Orsted-Eversource requested a smaller hike of 27% increase for its 924MW Sunrise Wind farm, to $139.99/MWh.

“Empire Wind 1 is a defining project for Equinor and the PSA agreement is an important milestone in de-risking and ensuring a robust path forward as we work toward delivering first power,” said Molly Morris, president of Equinor Renewables Americas.

An OREC represents the energy attributes of a single MWh of offshore wind power, according to Nyserda.

Orsted with joint venture partner Eversource likewise rebid Sunrise in round 4 and was awarded at a nominal indexed strike price of $146/MWh. Eversource is in process of selling its stake in the project back to Orsted.

“Sunrise Wind, providing clean reliable power to the State of New York, will be a centerpiece of America’s clean energy transformation,” said David Hardy, Orsted CEO for the Americas.

The project reached financial close 26 March and has begun onshore construction activities, Orsted confirmed.

Research consultancy BNEF estimates the levelised tariff for the re-awarded Empire and Sunrise projects at $109.7/MWh in real 2023 dollars across the 25-year contract terms, “significantly higher than the prices for their earlier contracts for the same projects,” according to senior wind associate Atin Jain.