GE unveils new Haliade-X designs to beat US offshore wind ban over Siemens Gamesa patent

New versions of flagship turbine at centre of IP row may satisfy court but OEM still faces pain and cost to bring them to market, expert says

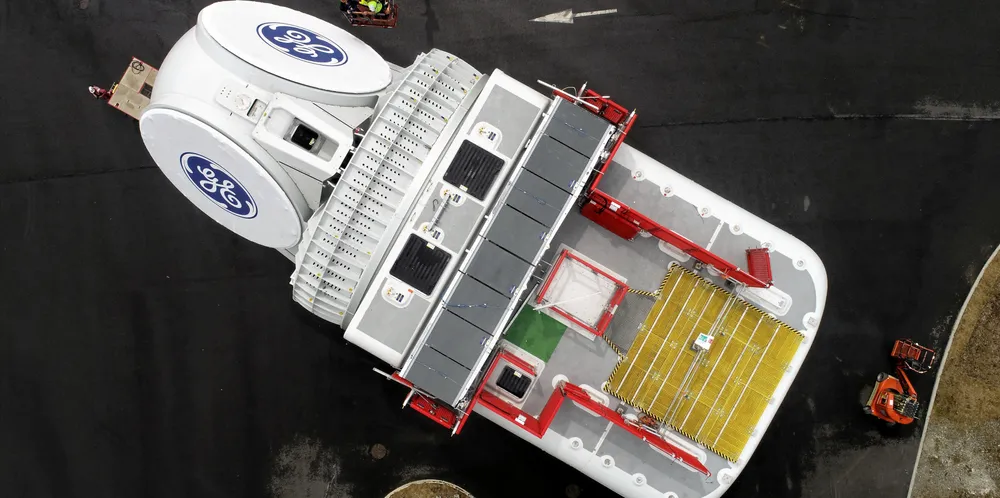

GE on Monday unveiled in a court filing two new versions of its Haliade-X offshore wind turbine that it says don’t include patented technology at the heart of litigation with Siemens Gamesa and subject to a US sales ban.

The first, the “Haliade-X-ii”, modifies the current generation, while the second, the “Haliade-X-iii”, is the design for the next generation of Haliade-X products, the company said.

“GE plans to make both the Haliade-X-ii and the Haliade-X-iii available to customers developing offshore wind farms in the US,” the turbine maker said in its petition to the court requesting exemptions from the current market ban.

In a long-running case involving the two turbine makers, the US district court for the District of Massachusetts found that the Haliade-X was in breach of a patent identified as 413 involving the placement of rotor bearings in the turbine.

GE has an estimated 11GW of US offshore capacity pipeline, all but 2GW barred by the court’s ruling, according to analysis by renewable energy consultancy IntelStor. The court granted carve-outs for the 800MW Vineyard Wind and 1.15GW Ocean Wind 1 projects due to concerns that a new supplier could not be found to meet the state contracted offtake targets.

Patent 413 places the front bearings for the main rotor within the interior of the rotor housing. GE says that the alternate Haliade-X designs “reposition the rotating shaft (what SGRE identified as the annular member) and the front bearing so that both are outside of the interior of the rotor hub’s hollow shell”.

According to GE, Siemens Gamesa’s complaint is narrowly based on turbines “having a bearing within an interior of a rotor hub”, and that claims of infringement “cannot extend to turbines that lack a bearing within the interior of a rotor hub’s hollow shell”.

“GE respectfully requests that the Court modify the Final Judgment [by] adding the following paragraph to the Injunction: ‘GE’s Haliade-X-ii and Haliade-X-iii designs, as reflected in the design documentation submitted to the Court, are not subject to this injunction,” the company said.

'GE may be able to win'

Philip Totaro, CEO of IntelStor and an expert on patent cases, said design specs revealed by GE put it in a good position to win its request for a carve out for the new designs.

Nevertheless, the turbine maker would likely still feel the pain of the injunction through added costs and time needed to roll out the new models.

He also noted that having different versions of the Haliade-X will require splitting the supply chain among them, thereby reducing economies of scale while also forcing the company to retool factories and recertify designs.

“It will necessarily mean extra cost for the customers of either the original Haliade-X in Europe [or] the new design for the US market,” Totaro said, forecasting that GE will need 12-18 months before the new versions will hit the market.

While the alternate Haliade-X models might allow GE “to offer their turbine for sale again… it doesn’t speed up the process to get the alterative design to market, so the injunction is still a big blow to them commercially.”

“This is the profound impact that an IP litigation can have on any company,” said Totaro.

A GE spokesperson said: “We are confident in our application for two design-around options for the Haliade-X. Our engineers are confident it will not impact turbine operation or maintenance, including energy production, component performance, or ability to service and maintain the turbines.”

(Copyright)