'Growing need'| Apex unveils two battery storage projects as Texas grid concerns heighten

The Angelo and Great Kiskadee facilities will each deliver 100MW/200MWh of capacity for two hours and also provide energy arbitrage and ancillary grid services

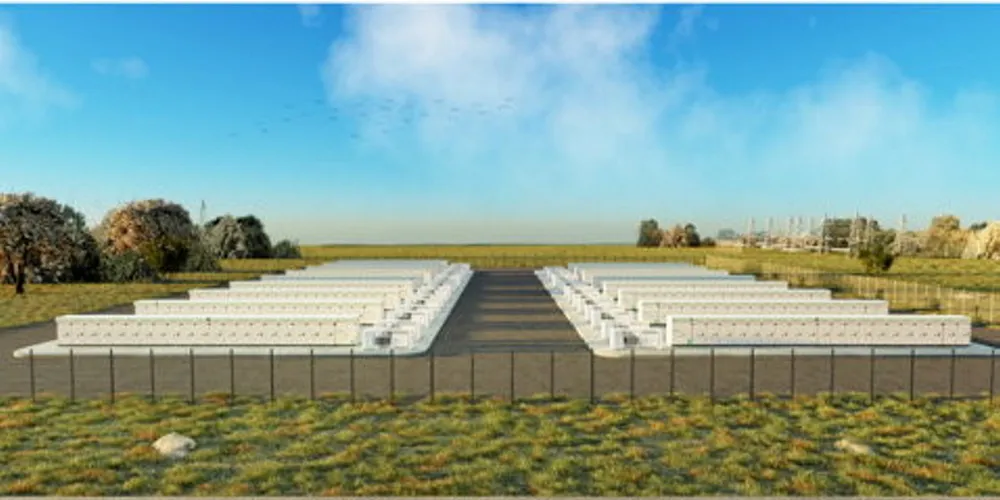

Developer Apex Clean Energy has announced two battery storage projects totaling 200MW/400MWh of capacity in Texas amid public concern that its main power grid could experience outages this summer during peak demand for electricity.

Apex developed and will construct, own, and operate the projects. Angelo Storage is co-located with the 195MW Angelo Solar Project in West Texas, while Great Kiskadee Storage is standalone in far South Texas near the border with Mexico.

Each will deliver 100MW/200MWh of capacity to the grid with a two-hour battery duration – the amount of time a storage system can discharge at its rated power capacity before depleting its energy.

The projects will employ Powin’s proprietary battery management systems to provide energy arbitrage and ancillary grid services to help maintain grid reliability in ERCOT, which serves 90% of the state’s electric load.

“As Texas experiences more extreme weather conditions in both summer and winter months, there’s a growing need for cleaner and more reliable energy,” said Geoff Brown, CEO of Powin, which is based in Oregon.

“With visibility and control down to the battery cell level, our platform can respond to changing grid conditions in real-time,” he added.

Powin’s Centipede modular energy storage platform uses batteries with lithium iron phosphate as the cathode material and a graphite carbon electrode with a metallic backing as the anode.

In January, Apex announced an environmental attribute purchase agreement involving renewable energy credits with Meta for the full capacity of Angelo Solar. It was the sixth deal betwen the two companies.Apex anticipates that Angelo Solar will begin commercial operation in the fourth quarter and Great Kiskadee in 2024.

Texas is the largest state market for both electric power and renewable energy, and has been a main driver of US onshore wind capacity development over the last 15 years.

After California, Texas is also second among states with 1.87GW/2.26GWh utility battery storage capacity in operation on 1 January. At that time, the US had 25.2GW of cumulative capacity.

Where Texas lags is storage duration. Operating battery storage facilities have a weighted average duration of 1.32 hours, 14th among states, less than half the 2.82-hour US average and far below 3.1 hours in California, according to American Clean Power Association, a national trade group.

That’s one of various reasons ERCOT this decade has struggled to muster and sustain on-demand power during peak electricity usage periods in the hot summer months of June through September.

Having more on-demand power could also have mitigated impacts of Winter Storm Uri in February 2021, which brought the grid to the brink of collapse.

Peter Lake, chairman of the Public Utility Commission (PUC), has been sounding the alert on the need for much more dispatchable battery storage and natural gas-fired power plants.

According to a new report by PUC, peak demand for electricity this summer will surpass the amount ERCOT will be able to generate from on-demand, dispatchable power, placing more reliance on intermittent solar and wind.

The climate law signed by President Joe Biden last August extends the federal investment tax credit to standalone battery storage. The base rate is 6% of capital investment but increases to 30% if projects meet prevailing wage and registered apprenticeship requirements.

The credit is increased by up to 10 percentage points for projects meeting certain domestic content criteria for steel, iron, and manufactured products, and increased by up to the same amount if located in an energy community - brownfield sites, former coal-fired generating plants, or mine locations, and certain “statistical areas” tied to fossil activities.

(Copyright)