Iberdrola's Avangrid and Invenergy win floating wind leases in US Gulf of Maine

Developers pay almost $22m to split four leases covering deepwater sites

Iberdrola’s Avangrid Renewables and Invenergy won four offshore wind areas with potential to power more than 2.3 million homes in the US government’s first lease sales in the deepwater Gulf of Maine where floating turbines will be needed.

Avangrid paid $4.93m for Lease OCS-564 which consists of 98,565 acres (399 sq km) and $6.24m for Lease OCS-568 covering 124,897 acres. Both tracts are 29.5 nautical miles (54.6 km) from the state of Massachusetts coast.

Invenergy subsidiary Invenergy NE Offshore Wind won Lease OCS-562 consisting of 97,854 acres with a $4.89m bid and Lease OCS-567 covering 117,780 acres with a $5.89m offer.

“Today’s successful auction marks yet another critical step in our fight against climate change,” said Deb Haaland, secretary of the Department of Interior, whose agency Bureau of Ocean Energy Management (BOEM) oversees wind development on the federal outer continental shelf.

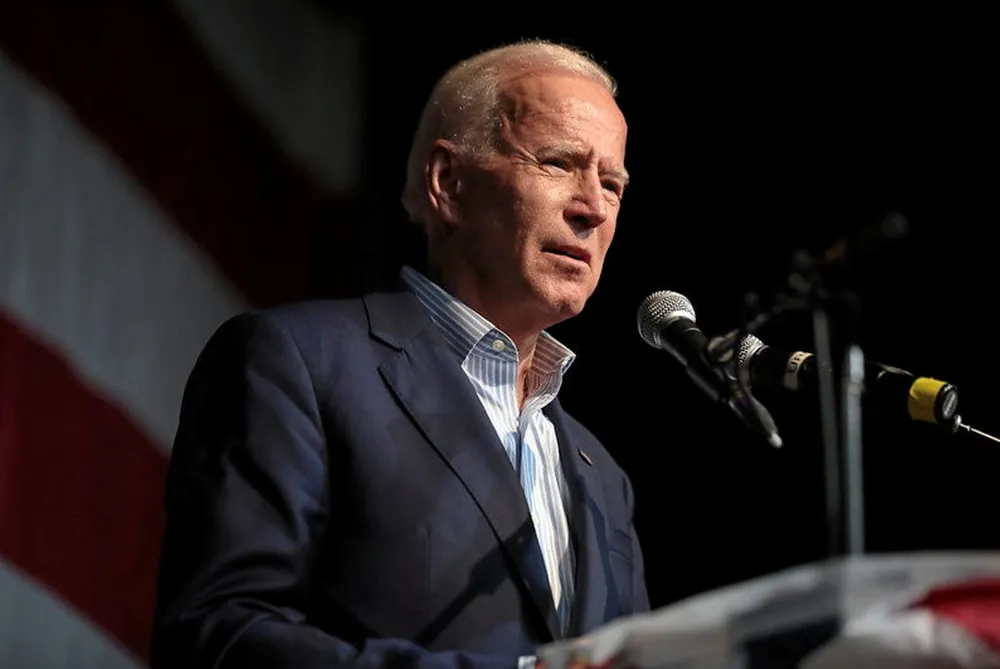

She said the lease sale is another “successful milestone” in the administration’s work to meet President Joe Biden’s ambitious goal of deploying 30GW of offshore wind generation capacity by 2030 and 15GW of floating wind by 2035.

The Gulf of Maine will require floating technologies given water depths that preclude use of fixed foundations.

Today’s sales resulted in over $5.4m in total bidding credits. These credits represent binding commitments by companies to invest over $2.7m in workforce training and domestic supply chain development, and an additional $2.7m for fisheries compensatory mitigation.

In addition, lease stipulations require that the lessees make every reasonable effort to enter into a project labour agreement covering the construction stage of any project for the lease areas.

Lease area winners also agreed to develop communication plans for engagement with tribes, agencies, and fisheries, and provide semi-annual reports on engagement activities with those tribes and communities.

Floating lag

Anne Reynolds, offshore wind vice president at industry advocacy group American Clean Power Association said: “With today’s lease sale building on earlier deepwater auctions on the West Coast, the United States is truly on track to become a global leader in floating offshore wind technology.”

This, along with political uncertainty and growing pushback from stakeholders, has quashed demand for deepwater leases in the US.

“Most developers are trying to focus on bottom fixed because this is the most realistic on a shorter term, five to seven years, while floating will take a bit longer,” said Adrian Bucica, senior adviser in strategic leadership for offshore wind consultancy Green Ducklings.

“This is the start of the Gulf of Maine, and just like off the coast of Southern Massachusetts and Rhode Island, we started with just a couple of these areas and then we added more,” said Elizabeth Mahoney, commissioner of the Massachusetts Department of Energy Resources (DOER), the agency overseeing the state's offshore wind development. “We look forward to that.”