'Never more attractive' | US top target for renewable dollars in IRA fuelled environment: Acore

Clean energy group's survey finds sector players bullish as climate law-drives investment, with energy storage and solar leading segments

Investors are unanimous in their view that landmark climate legislation passed last year has transformed the US into the world’s top destination for renewable energy investments, a survey released by advocacy group American Council on Renewable Energy (Acore) revealed.

The Inflation Reduction Act (IRA) passed last year channels some $369bn towards clean energy development, sparking a surge into the nation’s renewables sector.

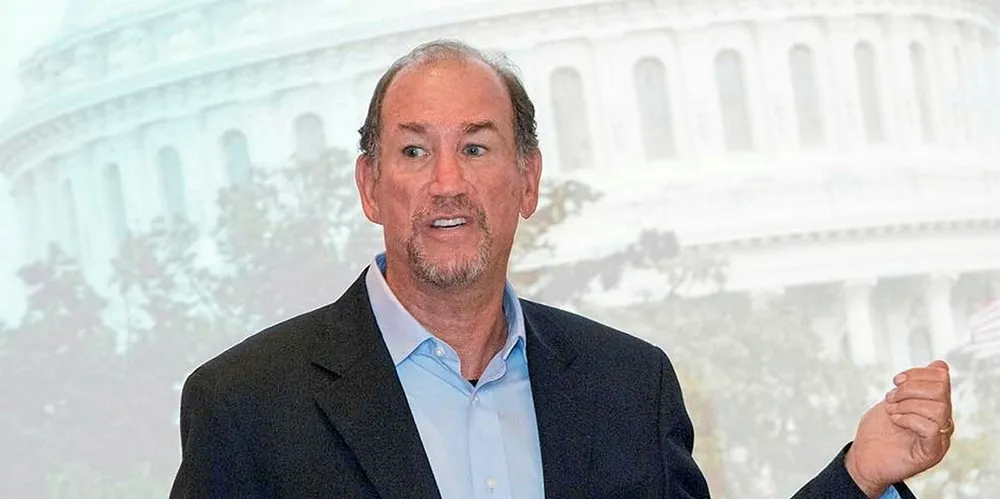

“America has never been a more attractive venue for renewable energy investment than it is today, thanks largely to the policy certainty provided by the IRA,” said Gregory Wetstone, Acore CEO.

Investors unanimously expect the US to increase in attractiveness for renewable energy investment in 2023-2026 compared to other countries, Acore said.

“This is the first time we ever got 100%” in the six years that Acore has conducted its survey, Wetstone told a forum on renewable energy financing today (7 June).

The group surveyed 24 developers and 19 investors active in the market on their near- and mid-term outlooks of the sector, including “the availability of project financing sources in a post-IRA implementation landscape”, Acore said.

Respondents were mostly C-suite executives for firms that annually invest or earn $100m or more in the US renewable energy sector.

All surveyed developers and most investors said they plan to increase their activity in the US renewable energy sector compared to last year and none plan to decrease their activity.

Acore noted that investors are concerned about the transferability, direct pay, and traditional tax equity of the massive tax credits in the IRA.

Despite this optimism, Wetstone warned: “There are still serious market challenges that must be resolved to realise the potential of the IRA.”

Transmission logjams are a concern, with the IRA failing to deliver investment tax credits (ITC) to incentivise gird investment.

Supply chain constraints in an inflationary environment likewise gave the sector pause, and Acore noted that one-third of developers have reduced their risk profiles.

“However, most large developers and many investors are willing to take on increased risks,” Acore said.

The full strength of the IRA has yet to emerge as the Treasury Department and its tax collection wing, the Internal Revenue Service (IRS) gradually release guidance on how the law will be applied.

This lack of clarity is evident in results that found that while one-third of investors and developers expect accessibility to tax equity to decline this year, 45% of tax equity-focused investors expect to see an increase over 2022.

“Developers tend to be expecting a decrease in tax equity, probably recognising how much demand is likely to increase,” said Wetstone.

Consensus was seen over the need to nearly triple the tax equity market, from $18-20bn annually to over $50bn, to meet heightened post-IRA demand.

The IRA includes substantial bonus tax credits to promote development in low- and moderate-income communities and energy communities, and they “seem to be working”, said Wetstone.

Acore noted that over 90% of surveyed investors and developers are prioritising such communities “to some extent in their renewable investment or development decisions”.

Energy communities are brownfield industrial and coal-mining and/or power generating districts that struggle with high unemployment and low income levels.

Investors ranked utility-scale solar, energy storage, and commercial solar as the top three most attractive clean energy sectors for investment over 2023-2026.

“That doesn't necessarily mean that's where the investments are going to go,” said Wetstone, noting that “storage has been near the top of this list for a long time, but the investment numbers have not been anywhere close to what we're seeing in generation.”

(Copyright)