US House passes $2trn Biden climate centrepiece but 'Build Back Better' faces Senate headwinds

Narrow win reflects deep political divisions over the massive controversial bill with all Democrats but one in favour and minority Republicans united in opposition

<b>Focus your mind: get the insight you need with the Recharge Agenda</b>

The global energy transition is gathering momentum – and the accompanying news-stream becoming an information deluge. Separate the green giants from the greenwash and the hard facts from the click-bait headlines with Recharge Agenda, our curation of the market-making events of the week, distilled down into one quick-read newsletter. Sign up here for free

The narrow 220-213 vote Friday on HR 5376 reflected the deep political divisions over the massive and controversial 2,135-page bill with all Democrats but one in favour and minority Republicans united in opposition.

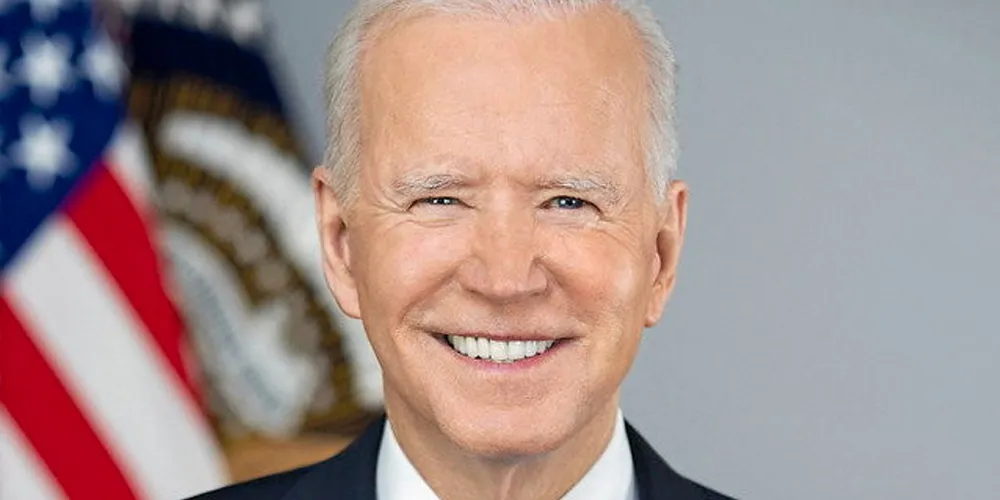

Biden said the result was “another giant step forward in carrying out my economic plan to create jobs, reduce costs, make our country more competitive, and give working people and the middle-class a fighting chance”.

According to the White House, the bill will significantly advance the country toward his three core 2030 climate targets: a 50-52% reduction from 2005 levels in economy-wide net greenhouse gas emissions, an 80% decline in utility sector emissions and installation of 30GW offshore wind capacity.

The bill heads to the evenly divided Senate where it will undergo certain changes to language and scope sought by centrist Democrats, although they have not objected publicly to most of the clean energy provisions.

Likely to be removed or modified are proposed higher fees for oil and fossil gas extraction and leases, and restrictions on new federal lands developments, and royalties on wellhead emissions of methane, a potent atmosphere-heating greenhouse gas.

Democratic leaders there aim to secure passage by Christmas with a simple majority using a special budget process called reconciliation with Vice President Kamala Harris in her role as president of the Senate, casting the deciding affirmative vote. All 50 Republicans have said they will vote against it, citing “wasteful” spending that will exacerbate runaway federal deficits.

US inflation hit a three-decade high in October with the consumer price index increasing 6.2% from a year ago. Prices jumped almost 1% last month, the largest gain since June, surpassing private forecasts and prompting concerns that inflationary pressures are spreading throughout the $22trn US economy.

Soaring prices have contributed to growing public dissatisfaction with Biden’s economic policies and were a key factor in Democrats’ poor showing in recent off-year elections. His approval ratings after 10 months in office are lower than those for predecessor Donald Trump at the same juncture of his presidency.

‘Vast subsidy programmes?’

Notably, stripped from the bill were any legally enforceable measures such as a carbon fines or taxes, or a cap-and-trade system, that would require major greenhouse gas sources including electric utilities and industry to reduce emissions.

The bill earmarks $190bn to create or expand clean energy and electric tax credits and $60bn for the same purpose for clean fuel and electric vehicles, according to the Committee for a Responsible Federal Budget, a leading nonpartisan, non-profit group focused on fiscal policy impacts based in Washington, DC.

Another $75bn in funding is targeted for other new or expanded climate-related tax benefits such as “green” manufacturing and workforce development, and $235bn is proposed for clean energy and climate resilience investments. These include $29bn to support rapid development of low- and zero-emission technologies and almost $6bn in rebates for residential electrification.

The bill leaves in place for 10 years the production tax credit (PTC), enacted in 1992 for eligible onshore wind projects, and the investment tax credit (ITC), which took effect in 2005 for solar installations and was later extended for offshore wind. Both have been phasing down in value with the PTC set to expire this year.

For wind and solar projects to qualify for the full value of either credit, the bill requires sponsors to use American-made inputs and products such as steel and union labour. These and other stipulations that Biden had lobbied have been contentious.

For example, the PTC would have a starting value of $5/MWh – versus $18/MWh value this year – and increase to a ceiling of $25/MWh depending to the degree that sponsors employ union apprentices as a percentage of their total workforce and adhere to paying prevailing wages.

These requirements and those for domestic content could add to project costs, making both technologies less competitive. Most onshore installations are performed by workers who don’t belong to unions and employ solar panels and wind turbines with a large percentage of imported content.

Biden has been courting the blue collar vote with union workers, once a bedrock constituency for the Democratic Party, increasingly voting Republican in the belief the party is more attuned to their economic and social concerns.

Clean hydrogen tax credits worth $9bn would apply for facilities that begin construction before 2029.

The bill also earmarks $275m to the Departments of Energy and Interior and Federal Energy Regulatory Commission to develop more "efficient, accurate, and timely reviews for planning, permitting and approval processes" for clean energy and climate beneficial infrastructure projects.

Doing this promises to be a challenge for Biden, who as vice president watched a similar initiative by the Obama administration struggle to make the federal bureaucracies more responsive with interstate transmission on public lands the most egregious example.

(Copyright)